Pa Estimated Tax Payments 2024 Deadline

Pa Estimated Tax Payments 2024 Deadline. The quarterly due dates for personal income tax estimated payments are as follows: Washington — the internal revenue service today reminded taxpayers the deadline to submit their third quarter estimated tax payment is sept.

An estimated tax payment is the amount of income tax you’re responsible for paying during the year when taxes are not withheld. The table below shows the payment deadlines for 2024.

Pa Estimated Tax Payments 2024 Deadline Images References :

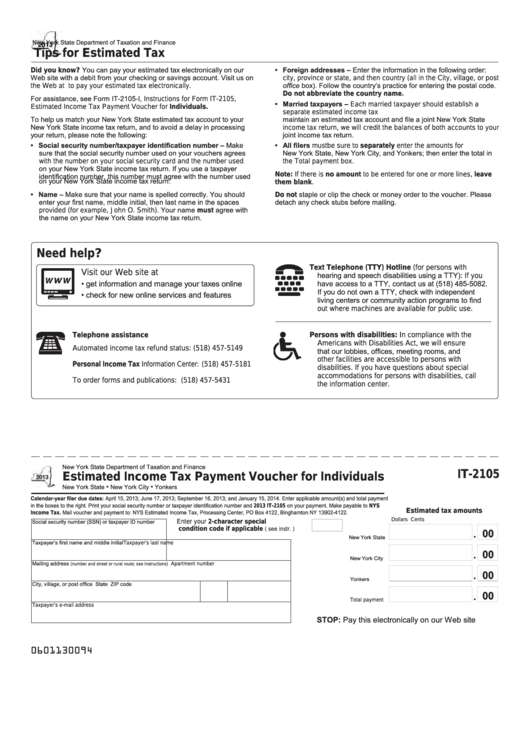

Source: reebeleonora.pages.dev

Source: reebeleonora.pages.dev

Pa Estimated Tax Payments 2024 Due Dates Pdf Cahra Juline, In the u.s., income taxes are collected on an ongoing basis.

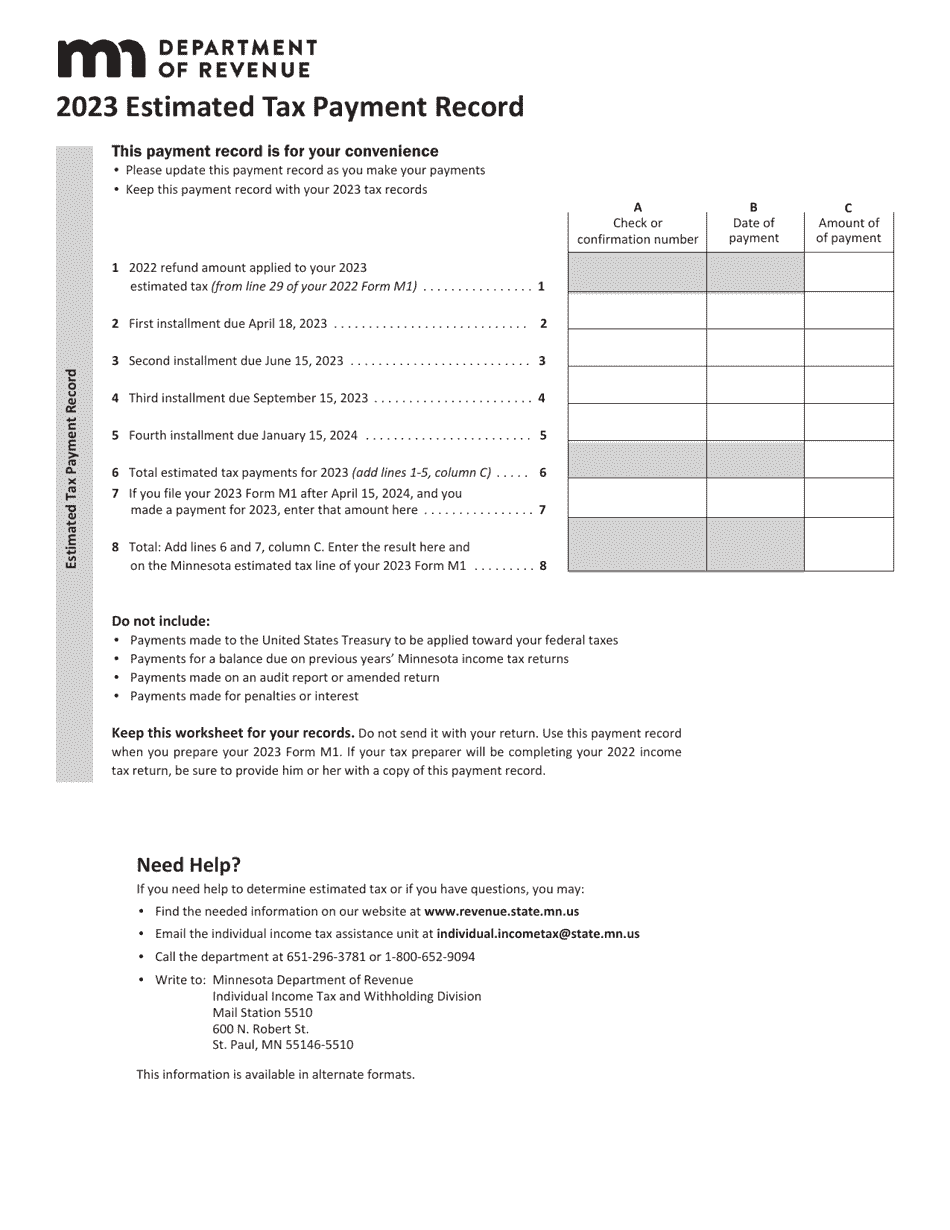

Source: jadeqlorianne.pages.dev

Source: jadeqlorianne.pages.dev

Pa Estimated Tax Payment Due Dates 2024 Celle Teirtza, This might include income from.

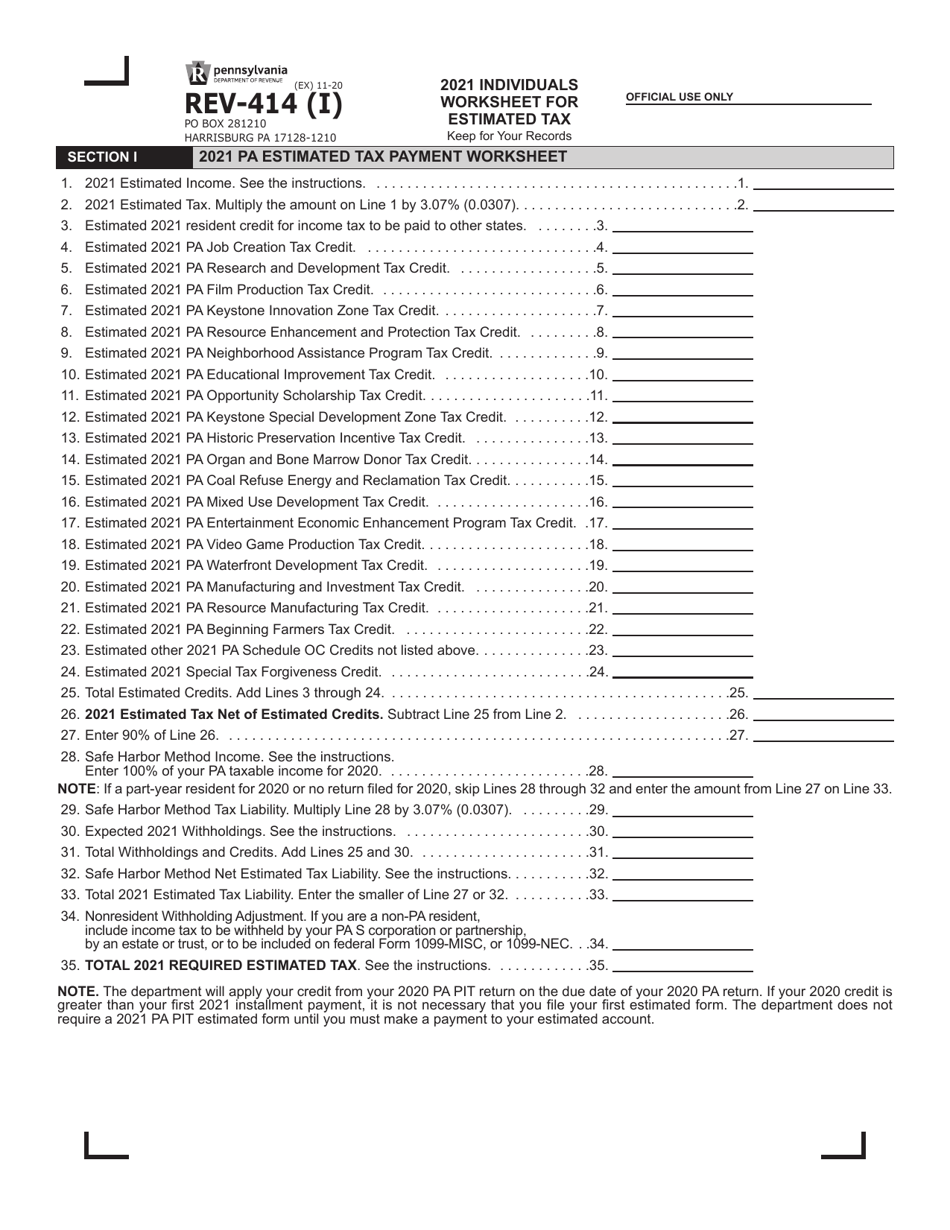

Source: marjqjessamyn.pages.dev

Source: marjqjessamyn.pages.dev

Pa Estimated Tax Payments 2024 Lanna Mirilla, The table below shows the payment deadlines for 2024.

Source: marjqjessamyn.pages.dev

Source: marjqjessamyn.pages.dev

Pa Estimated Tax Payments 2024 Lanna Mirilla, In general, quarterly estimated tax payments are due on the.

Source: eddyyteresa.pages.dev

Source: eddyyteresa.pages.dev

Making Pa Estimated Tax Payment 2024 Online Goldy Karissa, Payments for estimated taxes are due on four different quarterly dates throughout the year.

Source: meggiqmyrtie.pages.dev

Source: meggiqmyrtie.pages.dev

Pennsylvania Estimated Tax Payments 2024 Gabbey Arliene, The second quarter estimated tax payment deadline is june 17, 2024.

Source: hannisymariska.pages.dev

Source: hannisymariska.pages.dev

Pa Estimated Tax Payments 2024 In India Darda Elspeth, In general, quarterly estimated tax payments are due on the.

Source: sonjabbrigida.pages.dev

Source: sonjabbrigida.pages.dev

Pa Estimated Tax Payment Due Dates 2024 Jobi Brandice, Generally, if you owe $1,000 or more in state and county tax for the year that’s not covered by withholding taxes, you need to make estimated tax payments throughout the year.

Source: samymaitilde.pages.dev

Source: samymaitilde.pages.dev

Estimated Taxes 2024 Pa Tony Rozanna, The second quarter estimated tax payment deadline is june 17, 2024.

Source: marjqjessamyn.pages.dev

Source: marjqjessamyn.pages.dev

Pa Estimated Tax Payments 2024 Lanna Mirilla, Each state has a different deadline for their tax returns so be sure to consider which deadline is applicable to you.